New Feature: Instant Payments via RTP and FedNow

Network Profile: Ethereum

Ethereum Explored: A Look into the Pioneering Cryptocurrency

Overview

Ethereum (and it's native token ETH) - the cornerstone of smart contract platforms and a monumental evolution in the blockchain sphere. Ethereum isn't just another cryptocurrency; it embodies a comprehensive programming platform that has expanded the horizons of decentralized applications. A public, open-source platform, Ethereum has ignited a robust ecosystem, fostering a surge of innovation across various sectors.

Galvanizing the decentralized application movement, Ethereum presented the world with the concept of "smart contracts" – self-executing contracts with the terms of the agreement directly written into code. This revolutionary idea surpassed the mere exchange of currency, opening avenues for complex decentralized systems and applications. Its intrinsic technology, the Ethereum Virtual Machine (EVM), redefined versatility, enabling developers worldwide to craft solutions with unmatched security and flexibility, further democratizing the world of blockchain.

History

Ethereum, a groundbreaking platform for decentralized applications, was proposed in late 2013 by a programmer named Vitalik Buterin. Dissatisfied with Bitcoin's limited scripting capability, Buterin set out to create a blockchain that would support more complex operations, resulting in the inception of Ethereum. He introduced his vision through a whitepaper titled "Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform."

Ethereum's development was crowdfunded in 2014, and the network officially went live on July 30, 2015, with its first release called Frontier. Unlike Bitcoin, which was solely a digital currency, Ethereum introduced the concept of "smart contracts." These are self-executing contracts where the terms of agreement or conditions are directly written into lines of code, allowing for programmable and automated transactions.

Ethereum's vision and flexibility have earned it the moniker "world computer," as developers from across the globe collaborate to explore its vast potential. Over the years, Ethereum has grown to become the second-largest blockchain platform by market capitalization, only behind Bitcoin.

Account Based Model: Ethereum's Framework

Ethereum employs an account-based model, in contrast to Bitcoin's UTXO model. In Ethereum, the state of the blockchain is represented by a series of accounts. These accounts can be divided into two main types: externally owned accounts (EOAs) and contract accounts.

-

Externally Owned Accounts (EOAs): These represent individual user accounts. They possess an Ether balance and are controlled by private keys. Transactions initiated from EOAs involve transferring Ether or interacting with contract accounts.

-

Contract Accounts: These accounts contain the code of a smart contract. When a contract account receives a transaction, its code is executed, which can result in reading or altering the contract's internal storage, or even calling other contracts.

In Ethereum, when Alice wants to send 1 Ether to Bob, she directly decreases her account's balance by 1 Ether and increases Bob's account by the same amount. If Alice wants to interact with a smart contract, she sends a transaction to the contract's account, and the contract's code is executed.

The Bitcoin Upgrade Process:

A Model of Decentralized Consensus

-

Ethereum Improvement Proposals (EIPs): Similar to Bitcoin's BIPs, the Ethereum upgrade process starts with the submission of an Ethereum Improvement Proposal. This proposal outlines the suggested changes, their technical specifications, potential impacts, and the rationale behind them.

-

Community Deliberation: Post-submission, the EIP undergoes rigorous debate, critique, and discussion within the Ethereum community. Developers, node operators, and users analyze the feasibility and implications of the proposed changes, often leading to iterative refinements or alternative proposals.

-

Coding and Testing: If the community reaches a consensus on the EIP, developers initiate the coding process. This newly coded feature undergoes rigorous testing in testnet environments, ensuring that it doesn't present vulnerabilities or unintended consequences.

-

Implementation: Once satisfactorily tested, the upgrade gets incorporated into the various Ethereum clients like Geth or OpenEthereum. However, it doesn't become immediately operative. Ethereum often utilizes a mechanism like "fork blocks" where the network agrees to adopt the upgrade at a specific block number.

-

Network Upgrade (or Hard Fork): When the specified block number is reached, nodes running the updated client software will implement the changes, resulting in a network-wide upgrade or a "hard fork." Noteworthy hard forks in Ethereum's history include the likes of Constantinople, Istanbul, and Muir Glacier.

-

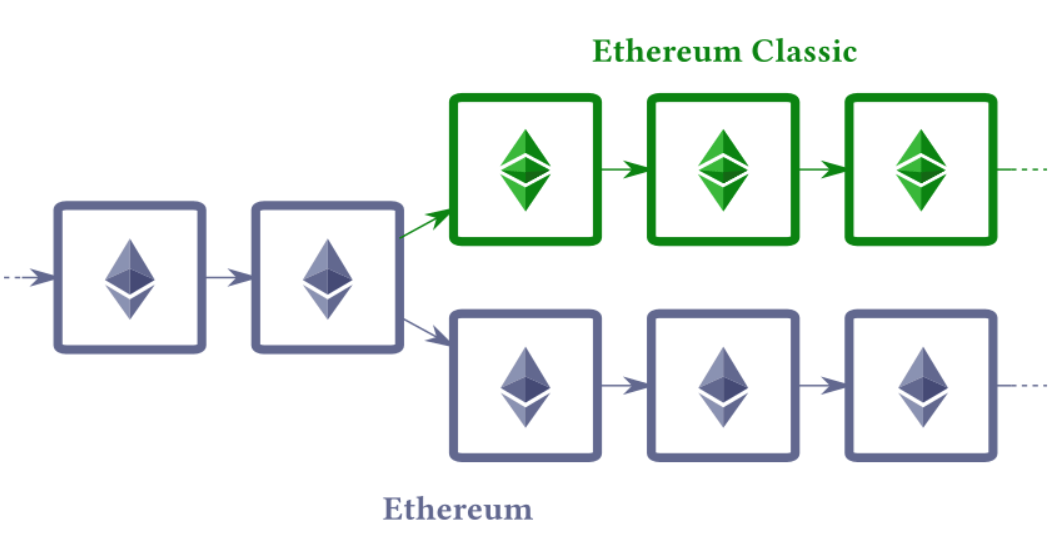

Community Adoption: It's pivotal for the broader Ethereum community, especially node operators and miners, to adopt and support the upgrade. If consensus isn't achieved, it can result in a network split, as seen with Ethereum and Ethereum Classic in 2016.

2016 DAO Hack: Ethereum Fork

In 2016, Ethereum witnessed one of its most pivotal moments: the DAO (Decentralized Autonomous Organization) exploit. The DAO was a complex smart contract designed as a decentralized venture capital fund. However, a vulnerability in its code was exploited, leading to a theft of around 3.6 million ETH.

In response, the Ethereum community was faced with a choice: let the attacker keep the stolen funds or perform a hard fork to revert the theft. A majority decided on the latter, leading to the DAO Hard Fork.

The Fork's Consequences

Post-fork, Ethereum was split into two chains: Ethereum (ETH) and Ethereum Classic (ETC). Those opposing the rollback continued to support the original chain, which was named Ethereum Classic. This event was a defining moment for Ethereum, highlighting both the strength and challenges of decentralized decision-making.

2020 and Beyond: Ethereum 2.0 & The Beacon Chain

Ethereum 2.0, commonly termed as Eth2 or Serenity, is an ongoing series of upgrades aimed at solving the scalability, security, and sustainability challenges of Ethereum. The most significant change in Ethereum 2.0 is the shift from a PoW consensus mechanism to PoS, significantly reducing the energy consumed in the process of securing the network.

The Beacon Chain, launched in December 2020, is the PoS blockchain running in parallel with Ethereum's existing PoW chain, ensuring the transition's security and stability.

For businesses, Ethereum 2.0 brings the promise of higher transaction throughput, lower costs, and an eco-friendlier blockchain. It aims to further establish Ethereum as a foundational layer of the decentralized internet.

Ethereum's journey, marked by these milestones, is a testament to its commitment to continuous innovation, decentralized governance, and the ever-evolving landscape of blockchain technology.

Ethereum's EIP-1559 and ETH Burning

EIP-1559, or Ethereum Improvement Proposal 1559, is one of the most discussed and significant changes to the Ethereum network's economic model. Implemented as part of the London Hard Fork in August 2021, this proposal introduced a mechanism where a portion of the transaction fees (known as the "base fee") is "burned," or permanently removed from circulation.

- Base Fee: A standard "base fee" is set for each block, which is adjusted up or down depending on network congestion. This base fee is burned, meaning it's removed from the total supply of ETH, reducing the overall circulation.

- Tip: In addition to the base fee, users can opt to include a "tip" to incentivize miners to prioritize their transactions. This tip goes to the miners and is not burned.

- Fee Cap: Users set a maximum fee they are willing to pay, which includes both the base fee and the tip.

- ETH Scarcity: By burning a portion of the transaction fees, the total supply of ETH is reduced over time, potentially increasing its scarcity and, in turn, its value.

- Predictable Fees: The new system provides more predictable transaction fees for users, as the base fee is algorithmically determined based on network demand.

- Reducing Miner Revenue: While the burning mechanism can increase the scarcity of ETH, it also reduces the revenue miners receive from transaction fees, as a part of it is now burned. This was a contentious point, but the broader Ethereum community saw the benefits of a more predictable fee structure and the economic implications of reducing ETH's overall supply.

Build with Ethereum

Connect with our team to learn how we empower ETH use cases.