Remittance

Infrastructure

Bringing secure, fast, and reliable remittance capabilities, via OpenAPI and SDKs, to businesses needing infrastructure in the United States & Canada.

Why Integrate Cybrid

The Cybrid platform offers a comprehensive, turnkey solution for businesses looking to simplify their crypto and fiat development process.

We strive to seamlessly bridge daily fiat-based transactions with the dynamic digital realm of stablecoins, ensuring each interaction is secure and compliant.

Leveraging our vast expertise in banking and payments, we've crafted an API platform that allows Fintech founders to easily architect and introduce products, powered by Cybrid's robust framework.

-

Account connection & ledgering

-

KYC, KYB & AML compliance

-

CAD & USD money transmission

-

Crypto liquidity & quote aggregation

-

Custodial crypto wallets

Seamless, Compliant Payments in Just 60 Days – Ready to Transform?

Experience the power of a cutting-edge payment orchestration platform. Book your free demo today!

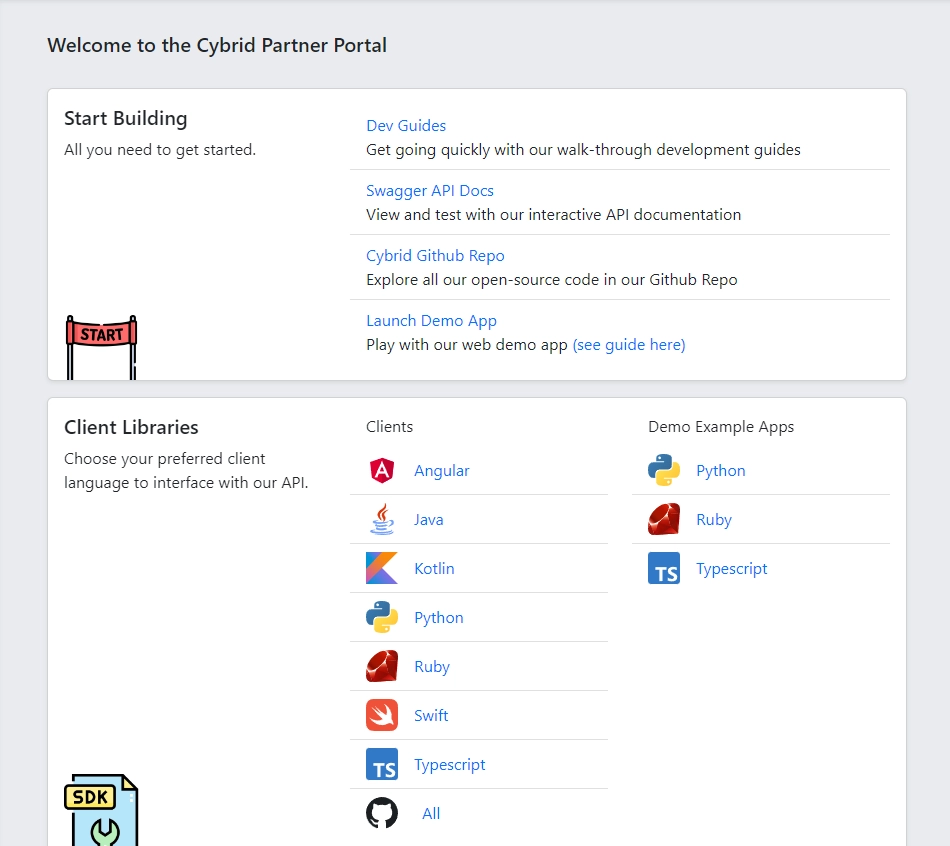

APIs and SDKs with a FREE sandbox

We collaborate with top-tier vendors to deliver minimal drop-out rates, detect potential fraud, and streamlines KYC & AML processes. Our solutions ensure a seamless user experience while maintaining the highest standards of security and compliance.

Our platform revolutionizes the trading experience by leveraging our Smart Order Router to simplify the quote, trade, and settlement process. Easily connect your application via our Web and Mobile SDK components.

Avoid the need to integrate multiple vendors. Users can effortlessly fund their accounts, convert fiat to crypto, and withdraw their earnings. Money transmission via Instant ACH, EFT, RTP, and Wire.

With industry-leading security measures, you can trust Multi-party Computation (MPC) walletsto store crypto assets while still enjoying easy access when needed. Easily embed functionality via our UI SDKs.

Frequently Asked Questions

We've summarised the most frequently asked questions to help you get started with learning more about Cybrid.

Remittance infrastructure refers to the integrated financial systems and technologies that enable the secure and efficient movement of money across borders.

Within the realm of embedded finance, this infrastructure is seamlessly incorporated into various platforms, enhancing user experiences by connecting fiat-based transactions with the dynamic world of digital assets, such as stablecoins.

Cybrid leverages its cutting-edge API platform and vast experience in the banking and payments industry to revolutionize the remittance process.

Our platform ensures swift money movement, supports USD and CAD FBO accounts at sponsor banks, and provides an end-to-end payment infrastructure.

The integrated KYC (Know Your Customer) process is pivotal in ensuring compliance with traditional finance regulatory norms and in preventing illicit financial activities. Cybrid's platform comes with an in-built KYC process that guarantees that every user and transaction adheres to international standards, thereby safeguarding businesses and individuals alike.

Cybrid's infrastructure facilitates an improved flow of funds, ensuring businesses can cater to end-users in the US and Canada. The platform's capability to support various fiat currencies and its association with a wide network of liquidity providers empowers businesses to operate seamlessly across borders, thereby expanding their global reach.

Absolutely. Cybrid's API platform is designed to be easily integrated into existing platforms, allowing businesses to enhance their offerings without overhauling their current systems. Our platform ensures seamless transactions, robust security, and adherence to regulatory norms, thus promising both enhanced user experience and operational efficiency.

Cybrid's emphasis on regulatory compliance, its commitment to bridging fiat transactions with the digital world, and its vast experience in the banking and payments arena make it a preferred choice. Furthermore, our state-of-the-art API platform ensures easy integration, providing businesses with the agility they need in today's rapidly evolving financial landscape.

We have licenses and banking relationships for USD and CAD FBO accounts. Using our Smart Order Router access Bitcoin (including Lightning) and USDC (on multiple chains).

Additionally, we collaborate with a network of liquidity providers who offer other fiat pairings.

The Remittance Platform Built For Developers

What Our Customers Say?

“Cybrid enabled us to reduce transaction processing time by 50%, improve operational efficiency by 40%, and achieve 3x growth within six months. Their seamless integration with our systems, robust compliance automation for KYC, KYB, and AML checks, and top-tier support allowed us to launch in production within twenty-two days."